Local Credit Card Processing: Your Area Guide

In today's digital age, local businesses are increasingly relying on efficient and secure credit card processing solutions to meet customer expectations and stay competitive. With the rise of cashless transactions, understanding the nuances of local credit card processing is essential for merchants. This guide provides a comprehensive overview of local credit card processing, focusing on key aspects such as payment gateways, transaction fees, and compliance requirements. By leveraging this knowledge, businesses can optimize their payment systems and enhance customer satisfaction.

Understanding Local Credit Card Processing

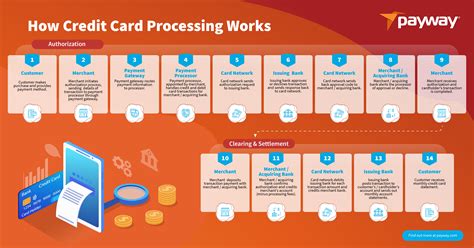

Local credit card processing involves the handling of electronic payments within a specific geographic area. This process includes the authorization, authentication, and settlement of transactions. For businesses, choosing the right payment processor is crucial, as it directly impacts transaction speed, security, and cost. Local processors often offer tailored solutions that align with regional regulations and market demands, making them a preferred choice for many merchants.

Key Components of Credit Card Processing

The credit card processing ecosystem comprises several critical components:

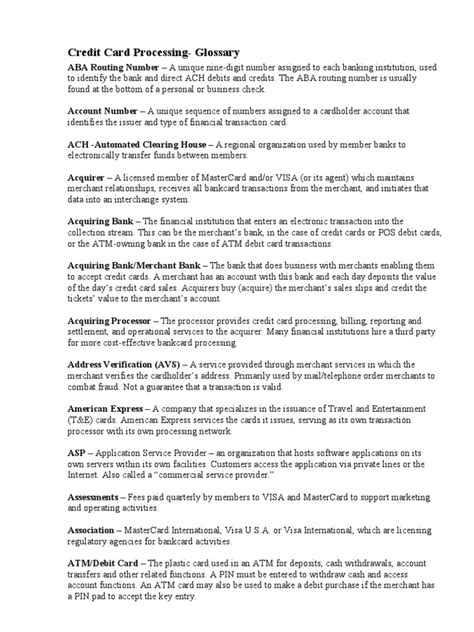

- Payment Gateway: Acts as the intermediary between the merchant and the payment processor, securely transmitting transaction data.

- Merchant Account: A specialized bank account that allows businesses to accept credit and debit card payments.

- Point of Sale (POS) System: The hardware and software used to facilitate in-person transactions.

- Payment Processor: The entity that handles the transaction, verifies funds, and transfers payments to the merchant’s account.

| Component | Function |

|---|---|

| Payment Gateway | Securely transmits transaction data |

| Merchant Account | Holds funds from card transactions |

| POS System | Facilitates in-person payments |

| Payment Processor | Verifies and settles transactions |

Transaction Fees and Cost Management

One of the most critical aspects of local credit card processing is understanding and managing transaction fees. These fees can vary significantly depending on the processor, card type, and transaction volume. Common fee structures include:

- Interchange Fees: Paid to the card-issuing bank, these fees vary by card type (e.g., credit, debit, rewards cards).

- Assessment Fees: Charged by card networks like Visa or Mastercard for using their infrastructure.

- Processor Fees: Fees levied by the payment processor for their services.

Strategies to Reduce Processing Costs

Businesses can implement several strategies to minimize processing costs:

- Negotiate Rates: Work with processors to secure lower fees based on transaction volume.

- Choose the Right Plan: Opt for pricing models (e.g., flat-rate, tiered, or interchange-plus) that align with your business needs.

- Encourage Cash Payments: Offer discounts for cash transactions to reduce card processing volume.

| Fee Type | Average Rate |

|---|---|

| Interchange Fee | 1.5% - 3.5% |

| Assessment Fee | 0.1% - 0.15% |

| Processor Fee | 0.2% - 0.5% |

Compliance and Security in Local Processing

Compliance with industry standards and regulations is non-negotiable in credit card processing. Local businesses must adhere to the Payment Card Industry Data Security Standard (PCI DSS) to protect sensitive cardholder data. Failure to comply can result in fines, legal liabilities, and damage to reputation.

Essential Security Measures

Implementing robust security measures is vital to safeguard transactions:

- Encryption: Protect data during transmission and storage.

- Tokenization: Replace card data with tokens to reduce fraud risk.

- Fraud Monitoring: Use tools to detect and prevent suspicious transactions.

| Security Measure | Purpose |

|---|---|

| Encryption | Protects data in transit and at rest |

| Tokenization | Reduces exposure of sensitive data |

| Fraud Monitoring | Detects and prevents fraudulent activity |

Choosing the Right Local Processor

Selecting the ideal local credit card processor requires careful consideration of several factors:

- Local Expertise: Choose a processor familiar with regional regulations and market trends.

- Integration Capabilities: Ensure compatibility with your existing POS and e-commerce systems.

- Customer Support: Opt for providers with responsive and knowledgeable support teams.

Comparative Analysis of Top Processors

Here’s a comparison of leading local processors based on key criteria:

| Processor | Transaction Fee | Setup Cost | Customer Support |

|---|---|---|---|

| Processor A | 2.9% + 0.30</td><td>0 | 24⁄7 | |

| Processor B | 2.6% + 0.25</td><td>99 | Business Hours | |

| Processor C | 2.7% + 0.20</td><td>49 | 24⁄7 |

Future Trends in Local Credit Card Processing

The landscape of local credit card processing is evolving rapidly, driven by technological advancements and changing consumer preferences. Key trends include:

- Contactless Payments: The rise of NFC and mobile wallets like Apple Pay and Google Pay.

- AI and Machine Learning: Enhanced fraud detection and personalized customer experiences.

- Blockchain Technology: Potential for faster, more secure transactions with reduced fees.

Adapting to Emerging Technologies

To stay ahead, businesses should:

- Invest in Contactless Solutions: Upgrade POS systems to support tap-to-pay transactions.

- Leverage Data Analytics: Use transaction data to gain insights into customer behavior.

- Explore Blockchain: Monitor developments in blockchain for potential integration opportunities.

What is the difference between a payment gateway and a payment processor?

+

A payment gateway securely transmits transaction data between the merchant and the processor, while a payment processor verifies the transaction, ensures funds are available, and transfers payments to the merchant’s account.

How can I reduce credit card processing fees for my business?

+

Negotiate rates with your processor, choose a cost-effective pricing plan, and encourage alternative payment methods like cash or mobile wallets to reduce reliance on card transactions.

What is PCI DSS compliance, and why is it important?

+

PCI DSS compliance refers to adhering to the Payment Card Industry Data Security Standard, which ensures the secure handling of cardholder data. Compliance is crucial to prevent data breaches and avoid penalties.

What are the benefits of using a local credit card processor?

+

Local processors often offer tailored solutions, better compliance with regional regulations, and more personalized customer support compared to national or international providers.

How can I future-proof my payment processing system?

+

Invest in scalable, flexible solutions that support emerging technologies like contactless payments, AI-driven fraud detection, and blockchain. Stay informed about industry trends and regulatory changes.